Over 150 million Americans are enrolled in government-funded insurance programs like Medicare and Medicaid. Yet, an estimated 10% of all claims submitted to these programs are either incorrectly reimbursed or improperly classified — costing the system billions annually.

Our system leverages

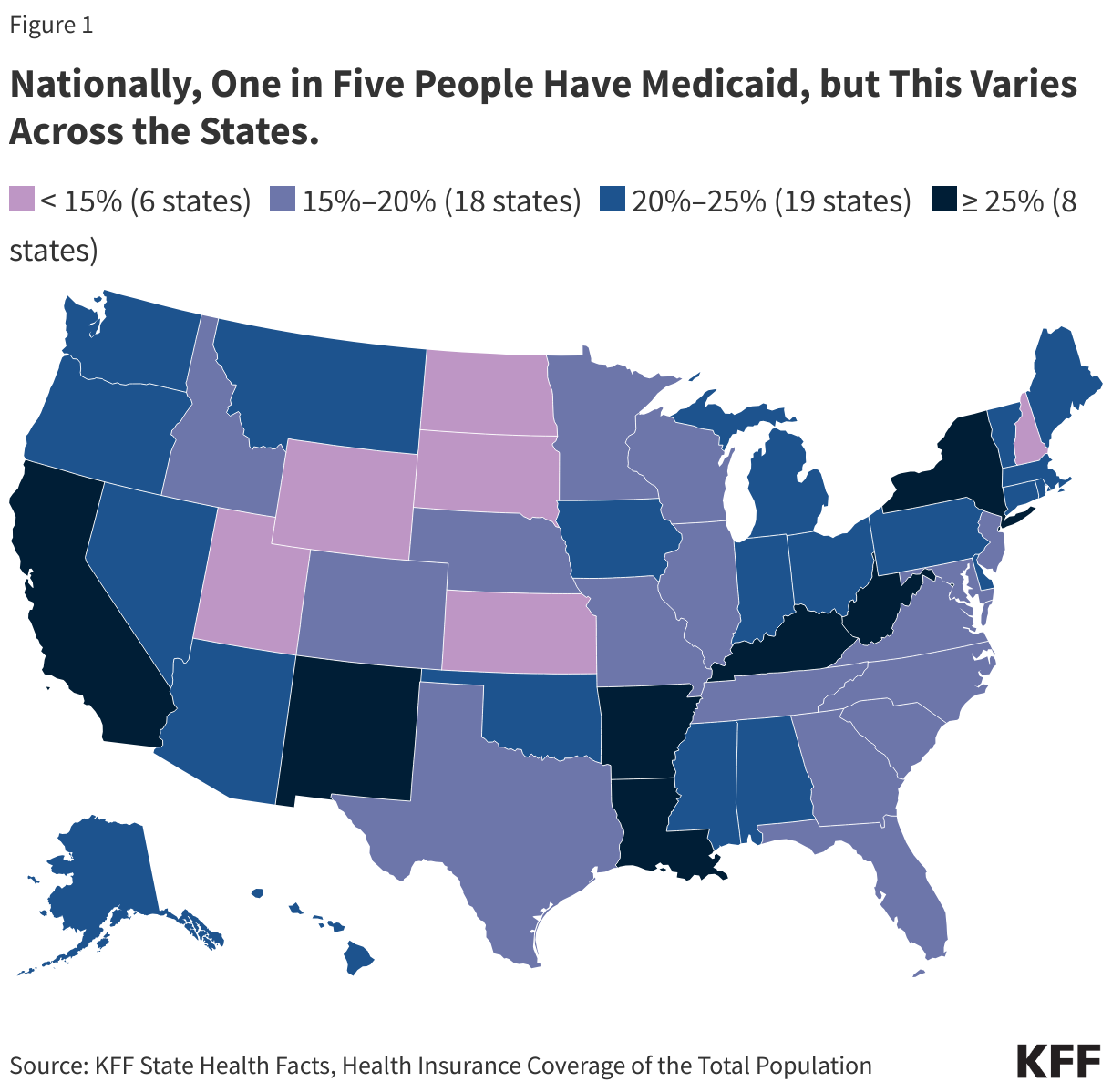

Demographic & Geographic Intelligence to analyze

patient profiles based on age, income, location, and known risk

zones for government-funded coverage.

It also integrates Real-Time CMS Data through

secure APIs to validate insurance eligibility and identify

potential fraud before claims are submitted.

Our fraud detection solution leverages demographic trends, geographic risk zones, and real-time CMS API data to identify patients likely covered under government-funded programs like Medicare and Medicaid.

This system enables providers and payers to proactively detect misclassified insurance coverage, minimize claim rejections, and reduce the risk of fraud by flagging discrepancies before billing or authorization occurs. With intelligent profiling and automated cross-checks, compliance becomes faster and more accurate.

Identify and flag suspicious claims in real time using demographic analysis and government insurance likelihood scoring.

Leverage CMS APIs to verify Medicare/Medicaid status before submission, minimizing denials and reducing reimbursement delays.

Access detailed reporting and trends on geographic fraud hotspots and population segments most at risk for misclassification.

Our fraud detection engine leverages real-time patient demographics, location data, and public insurance coverage patterns to estimate the likelihood that a patient is enrolled in Medicare or Medicaid.

We integrate directly with CMS APIs to cross-reference patient eligibility and validate insurance status before claims are submitted, reducing the risk of billing inaccuracies, rejections, or fraudulent activity.

By combining AI-driven analytics with authoritative government data, our platform streamlines the verification process and provides proactive alerts when a claim appears inconsistent with known Medicare/Medicaid patterns.

Our system is designed to seamlessly integrate into existing billing or EHR platforms via API, making implementation simple and scalable for teams of any size. Here’s how the process flows:

Copyright © Tekrata 2025